Starting a small company may be gratifying, whether you're looking for something to do in the home or simply want to earn some more money. But it may also be a difficult task.

Prior to starting your organization, it is crucial to get the necessary amount of time in success planning. In so doing, you may avoid errors and create the conditions for long-term success.

First, create a business plan.

Business plans assist organizations in defining their goals and staying on course to achieve them. Also, they are used to draw in lenders and investors.

The goods or services your organization will provide, the way it'll generate money, and the people it needs on its team are all laid out in a well-written business plan. Additionally, it describes the possibilities your organization can explore and how success will be measured.

An excellent company strategy starts with general market trends and budget creation. It is time to begin developing your strategy after you have this information.

The regular business plan or a lean startup strategy may be written. A lean startup strategy is concise and centered on the key elements of your company. Lenders and capital raising organizations often require a brief business plan.

Investigate Your Market

Step one in starting a small company is general market trends. It assists you in determining if the marketplace has a demand for your product or service and might provide you information about what your rivals are doing.

Although t here are many methods to conduct research, primary market research is the most important one. This involves leaving your personal computer behind and really speaking with prospective consumers.

If you execute it correctly, this will offer you a far clearer view of your competitors and what has to be done to keep up.

Focus groups, interviews, along with other inexpensive, do-it-yourself approaches may be used to perform this study. Asking the appropriate questions and gathering as much data as possible from various sources is the key.

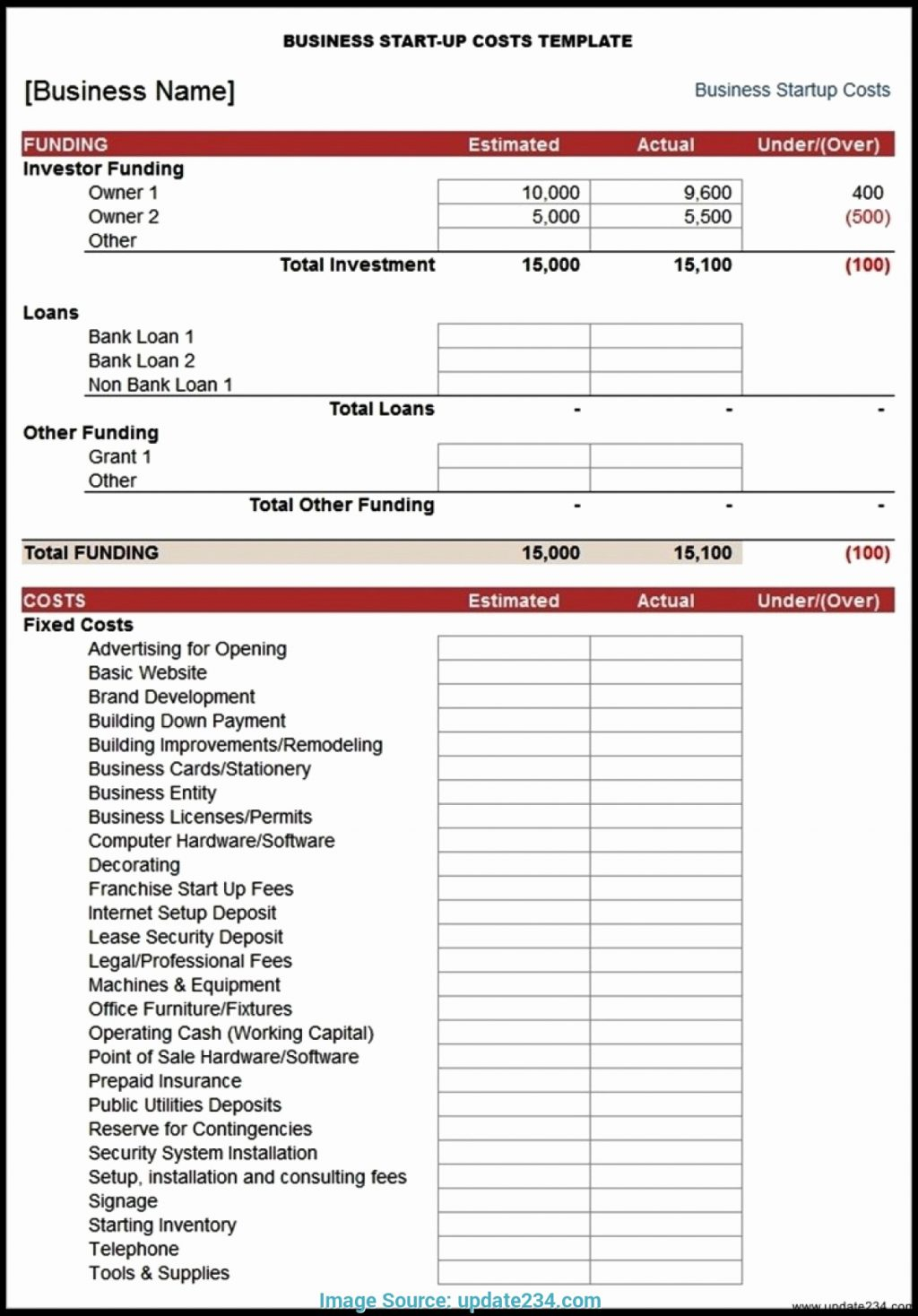

Establish a Budget

Small company entrepreneurs need a budget to aid them in forecasting their earnings and costs. Without one, a small business faces the danger of overspending or failing to establish a reliable emergency fund.

To ensure you have enough money to cover future expenses, you should investigate your costs and establish objectives while creating a cover your firm. Furthermore, it helps you identify areas where you are able to cut expenses if your organization is struggling.

In your budget, you need to account for all sources of revenue and also fixed expenditures like rent, mortgage payments, insurance premiums, and wages. Variable costs, or expenditures that alter during the year, should also be studied into account. These range from one-time expenses like training sessions or marketing fees as well as unforeseen expenses like travel costs.

Choose a Business Structure

As a fresh company owner, choosing your organizational structure is probably the most crucial choices you can create. Your tax and legal obligations, the number of documentation you need to complete, and your capacity to acquire outside capital are impacted.

The three most prevalent forms of business entities are sole proprietorships, partnerships, and S corporations. All of them has benefits and drawbacks.

Homepage may support your objectives, shield you from liabilities, and reduce your tax burden. But choosing the best structure is really a difficult choice that should only be made with the aid of a professional lawyer or accountant.

The only real proprietorship, partnership, limited liability company, corporation, and cooperative will be the five most typical business formations. Visit this link of company, amount of control you need, and development objectives all affect what structure is suitable for you.